The Federal Reserve announced on Wednesday that it was lowering the federal funds rate by half a percentage point (0.5%) or 50 basis points, its first rate cut in over four years.

The previous rate range set by the Fed was 5.25% to 5.5%, the highest in over two decades. Now the range is between 4.75% and 5%.

The announcement followed a Federal Open Market Committee meeting, one of eight scheduled meetings throughout the year. There are two more meetings planned for 2024, in November and December, where the Fed could bring rates down further.

“The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” an FOMC press release stated. “In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

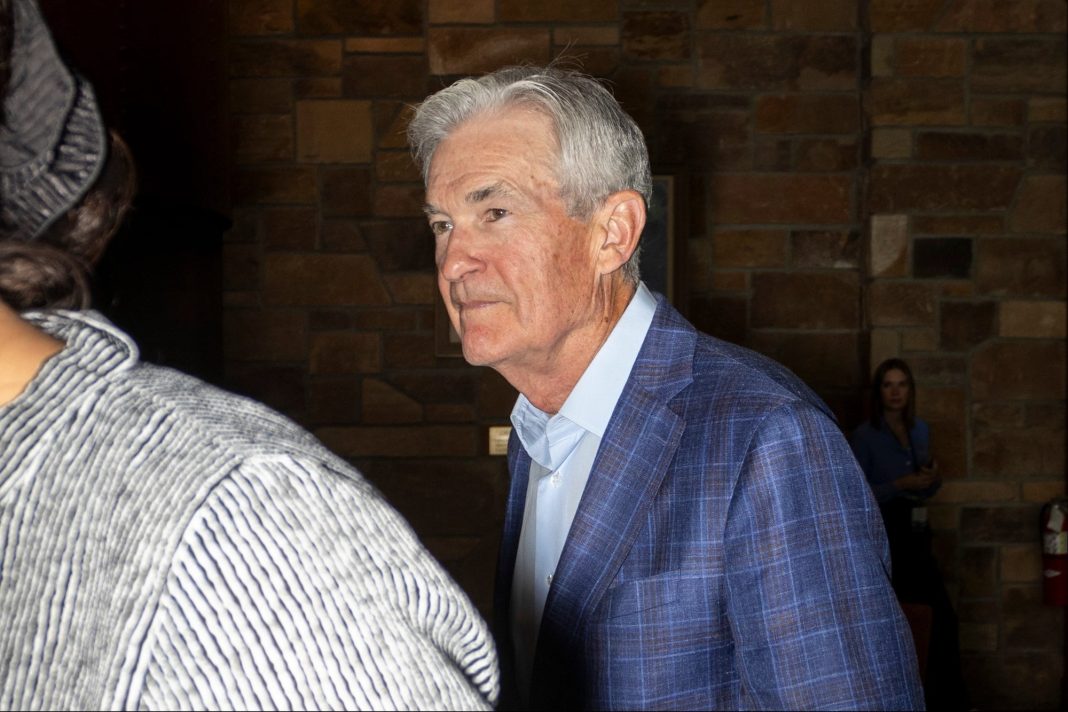

Federal Reserve chair Jerome Powell. Photo Credit: Natalie Behring/Bloomberg via Getty Images

Economists predicted the move. EY chief economist Gregory Daco told Entrepreneur last month that the question wasn’t if the Fed would ease the federal funds rate in September, but by how much.

He restated a prediction that EY senior economist Lydia Boussour told Entrepreneur — that there would be three rate cuts, each of at least 25 basis points or 0.25%, in September, November, and December.

Related: CPI Report: Inflation Hits 3-Year Low, Analysts Predict Fed Will Cut Rates Next Month

In a speech in August at Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell also foreshadowed the cut by saying that “the time has come for policy to adjust” to a cooling labor market.

“The Fed has fallen behind the curve, but Fed Chair Powell is playing catch-up,” Daco stated.

How Does the Fed’s Decision Impact You?

The Fed adjusts the federal funds rate, or the borrowing rate banks charge each other, in response to inflation and unemployment across the country. The aim is to keep prices stable and respond to the labor market.

Related: The August Jobs Report Didn’t Live Up to Expectations — Here’s What It Means For Interest Rates

The federal funds rate ripples out to borrowing costs consumers pay for credit cards, personal loans, and cars. According to Bankrate, rate adjustments usually happen within one to two billing cycles for loans with variable interest rates.

While mortgages are only partially influenced by the cut, the two tend to fall in line together. On Wednesday, rates fell to a two-year low of 6.15%. It is expected, based on the state of the economy and Treasury yields, that mortgage rates will continue to drop.

Banks individually choose how to respond to rate cuts and increases.

The federal rate also impacts purchasing power, job markets, and the stock market.